Canadian Packer Saga Continues?

加拿大加工厂的故事仍在继续?

It is reported on Tuesday this week, a Toronto, Ontario, Canada judge will be asked to appoint a receiver to sell the assets of Quality Meat Packers and Toronto Abattoirs Ltd., two related companies.

本周二报道,加拿大安大略省多伦多一场审判将被要求指定一名接管人来出售Quality肉品加工厂和多伦多屠宰厂等两家相关公司的资产。

The two companies owned by the Toronto's Swartz family, owes about $70 million to creditors that include pig farms. Capacity of plant was 30,000 per week approximately.

由多伦多斯沃茨家族(Swartzfamily)拥有的两家公司欠了包括养猪场的债权人约7000万美元。工厂的屠宰能力约为每周30,000头。

The plant has been owned by the Swartz family for three generations. Some reasons given for the business failure:

斯沃茨家庭已经连续三代人拥有这个工厂。以下是商业失败的部分原因:

· Recent jump in hog prices

· 近期的生猪价格波动

· PED

· 猪流行性腹泻

Our Observations

我们的观察

· All packers have had increased hog prices.

· 所有的加工厂都提高了生猪价格。

· PED has hit the whole industry. Ontario has had PED but at levels much lower than in the USA.

· 猪流行性腹泻已经影响了整个行业。安大略发生猪流行性腹泻发生情况比美国少得多。

· 70 hog farmers are not paid. Hogs were bought, the pork was sold. Why is there no money for the farmers hogs?

· 有70家养猪户没有收到钱。猪都买了,猪肉也卖了。为什么农民的猪还没有收到钱?

· 750 employees will probably lose their jobs

· 750名员工将可能失去工作。

· We are in tough business it's not for the faint hearted. Adjust or die. Other packers are doing just fine in Ontario, Conestoga a competitor to Quality has just expanded. Fearmans Pork has new aggressive owners moving forward. Buying in the same market, selling pork in the same market. We expect the difference is leadership – management focus.

· 我们正处在艰难的行业,这不是一件轻松的事情。不调整就灭亡。安大略省其它一些运行情况一般的加工厂,如Quality的竞争对手Conestoga正在扩张。Fearmans猪肉的新业主正在积极向前推进。在同一个市场采购,也在同一个市场出售猪肉。我们估计其中的差别就是领导力和管理水平。

Strange

奇怪

We are having record high hog prices a reflection of pork demand. It's interesting that in the midst of record profits companies like Quality Meats and Choice Genetics go into receivership and or bankruptcy. How bankrupt companies expect to keep their customers when suppliers will demand cash and warranty or product assurances can't be really guaranteed with credibility. It's like believing in the Easter Bunny. Maybe in Choice Genetics case who are minus $20+ million to creditors, it is possible as Group Grimaud the French shareholders of the bankrupt Choice Genetics company breeds rabbits as a primary business. Business plan: Easter Bunny Saves the Day!

我们的生猪创下历史高度,反映了猪肉的需求情况。有趣的是,在利润创下纪录情况下,像Quality肉品和Choice遗传这样的公司会进入破产接管或破产。供应商将要求现金交易,而信用无法保证产品质量,破产企业怎么能留住他们的客户。这就好像相信复活节兔子一样。或许在2千多万美元负债的Choice遗传公司,他们的法国股东克里莫集团可以将兔子育种作为主营业务。商业计划书:复活节兔子拯救世界!

Hedging

套期保值

We have written about the margin calls our industry has probably paid in the last few months. Not only putting huge cash flow pressure on companies but also limiting profits in a time of once in a generation profitability.

我们说过我们行业在过去几个月可能已经支付的追加保证金。这些公司面临的不仅是巨大现金流压力,还有在这种千载难逢的机会中的利润有限。

Mark Greenwood, Senior Vice President, relationship management, Agstar Financial Services writing in April National Hog Farmer.

马克·格林伍德(MarkGreenwood,Agstar金融服务公司关系管理高级副总裁)在四月刊的《全国猪农》写道。

“We have producers who have practiced margin management over the past year who are now funding margin calls at a record pace. Table 1, shows our portfolio at Agstar. You can see increased volume compared to a year ago. The chart shows that we are up $500 million, and our best guess is that the majority is sitting in Chicago today.”

“我们有一些生产者在去年中实行了利润管理,他们现在正以史无前例的速度支付追加保证金。表1显示了我们Agstar的的投资组合。与一年前相比,你们可以看到总量增加。图表表明我们的投资多达5亿美元,我们最好的猜测就是今天大多数资产都在芝加哥。”

Agstar is on bank with almost $500 million in Chicago! How much is in Chicago funded by producers and the banks? $2 billion? Seems the sharpies not the producers got a lot of the money in the hog price run up.

Agstar有将近5亿美元在芝加哥!芝加哥有多少资金是生产者和银行的?20亿美元?看来在猪价上涨时,大多数钱都被奸商而不是生产者赚走了。

If you want to lose all faith in trading read the book Flash Boys by Michael Lewis. Rigged Casino, Sharpies win, Main Street loses.

如果你不想在贸易中失去信心,去读一下迈克尔·刘易斯的《快闪小子》(FlashBoys)。这是被操纵的赌场,奸商战胜小企业。

Margin calls – Hedging and PED combination could be limiting profits of many of a producer. This will limit expansion as profits to fill the equity hole created over the last few years will not be filled as quickly as we might expect.

追加保证金、套期保值和猪流行性腹泻的组合影响了很多生产商的利润。由于赚到的利润被用来填补过去几年的财务亏空,我们预期这些亏空在短期内无法快速填补,这将限制到扩张的情况。

Markets

商品猪

Hog prices still very strong at $112 lean. We expect supply will start to see aggressive declines towards the end of May. Prices should surge higher. A producer asked last week if we can average $1.00 lean for the next 18 months.

瘦肉猪价格仍然强劲,达112美元。我们预计到五月底将看到供应量大幅回落。价格将会飙升。上周有个生产者问我们,将来18个月,瘦肉猪的平均价值是否能保持在1美元。

Good question – Our Answer: We expect so with confidence.

这是很好的问题。我们的回答是:我们有信心预测。

Last week we were in Kansas, Oklahoma, and Texas. We found it remarkable the large cattle feedlots we saw that were totally empty or were significantly less than full. Obviously a cattle inventory the lowest in sixty years leads to empty feedlots. Less beef is obviously quite bullish for pork prices. Droughts, high cost of business, capital needs, lack of profitability, you wonder if the cattle industry will ever expand or just keep contracting.

上周,我们在堪萨斯州、俄克拉荷马州和得克萨斯州。我们发现那里的大型肉牛场很多是完全空置或明显没有满栏。显然,60年来最低的肉牛存栏导致了饲育场空栏的现象。牛肉减少显然对猪肉价格是好消息。干旱、高商业成本、资本需求、缺乏利润,你说肉牛行业是会扩张还是继续缩小。

责任编辑:

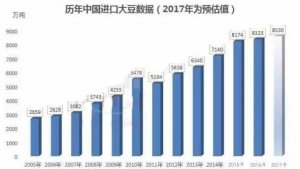

养殖终端全军覆没,进口肉继续搞垮粮食市场!

养殖终端全军覆没,进口肉继续搞垮粮食市场! 加拿大对中国出口猪肉,承诺在饲养时不用瘦肉精

加拿大对中国出口猪肉,承诺在饲养时不用瘦肉精 加拿大对中国出口猪肉,承诺不用瘦肉精

加拿大对中国出口猪肉,承诺不用瘦肉精 外媒:加拿大对华猪肉出口超美国

外媒:加拿大对华猪肉出口超美国